Child Tax Credit 2024 Irs Forms – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .

Child Tax Credit 2024 Irs Forms

Source : www.woodtv.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

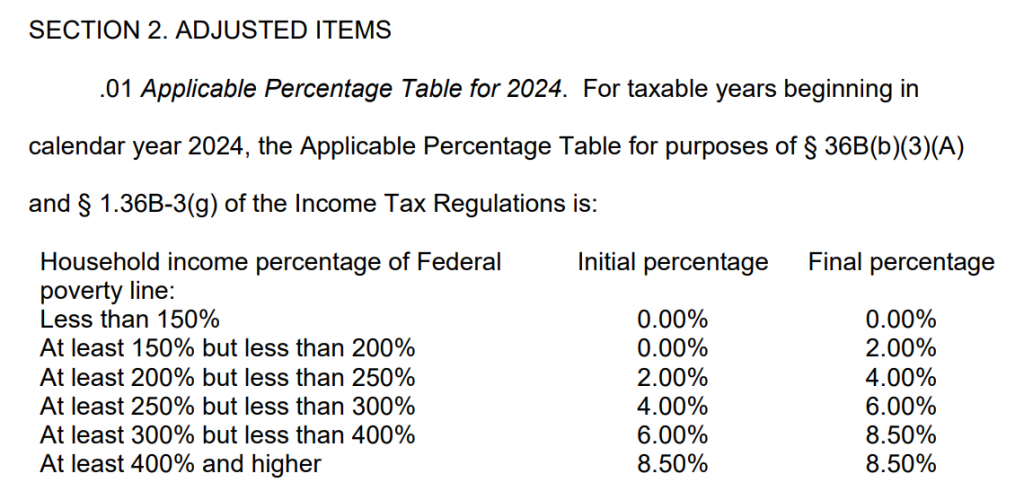

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

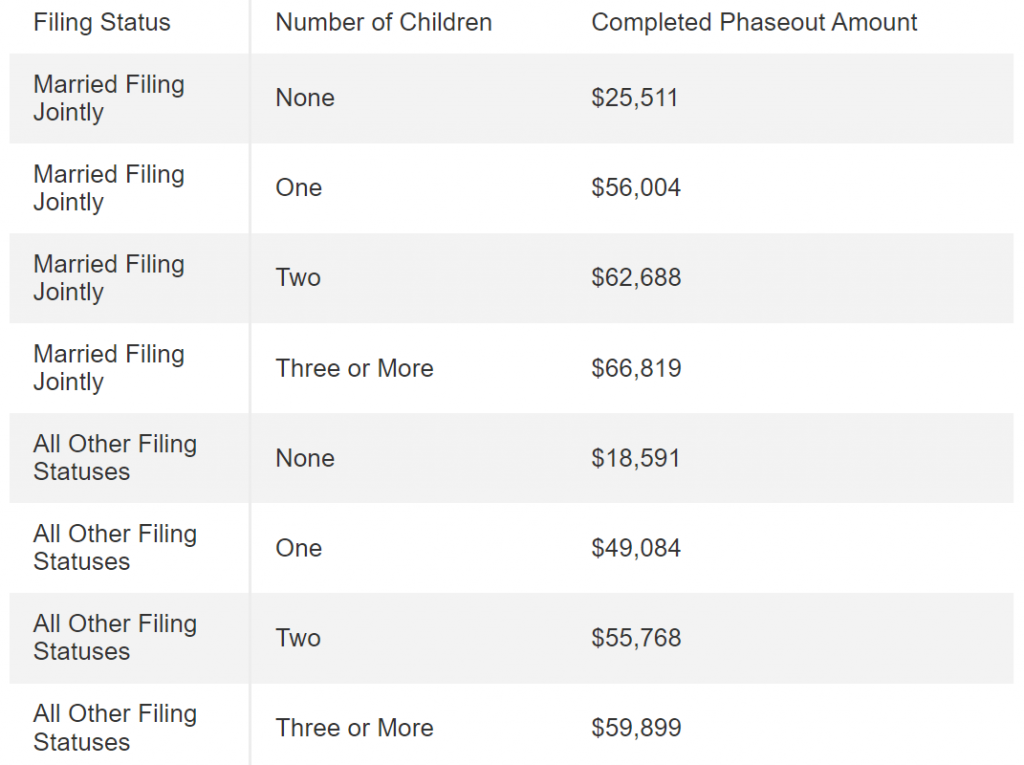

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

IRS releases 2024 tax brackets; What is new standard deduction

Source : www.al.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

American Opportunity Tax Credit (AOTC): Definition and Benefits

Source : www.investopedia.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Child Tax Credit 2024 Irs Forms Understanding IRS Form 8812 for Child Tax Credit in 2023 and 2024: The child tax credit pays up to $2,000 for each qualifying child under age 17. Up to $1,600 of the payout is refundable for 2023 taxes. There are also 14 states that offer their own child tax credit, . Here is what you should know about the child tax credit for this year’s tax season and whether you qualify for it. .

:max_bytes(150000):strip_icc()/Screenshot2023-03-30at1.06.15PM-4cd9ea80b5724ecb94d8cbc88fae95da.png)