Retroactive Tax Credits 2024 Meaningful – The current draft of the Tax Relief for American Families and Workers Act of 2024 includes a proposed provision that would dramatically accelerate the deadline to file claims for the Employee . The Inflation Reduction Act offers a tax credit worth up to $7,500 to those who buy new electric vehicles. It also offers a $4,000 credit for used EVs. New rules for 2024 will allow buyers to get .

Retroactive Tax Credits 2024 Meaningful

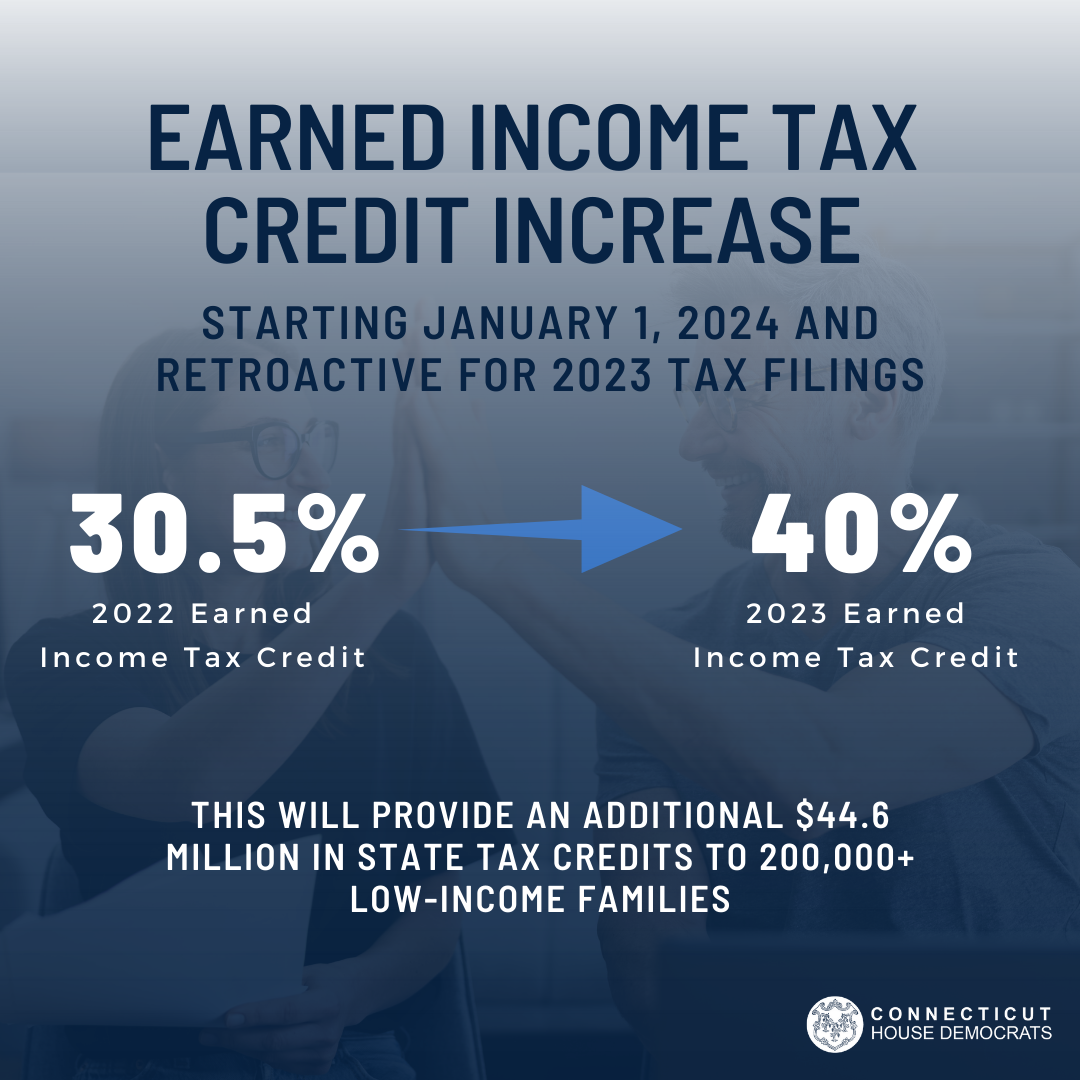

Source : www.housedems.ct.gov

CT House Democrats (@CTHouseDems) / X

Source : twitter.com

State Representative Jason Rojas

Source : www.facebook.com

Federal Solar Tax Credit 2024: What It Is & How Does It Work

Source : www.freshbooks.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

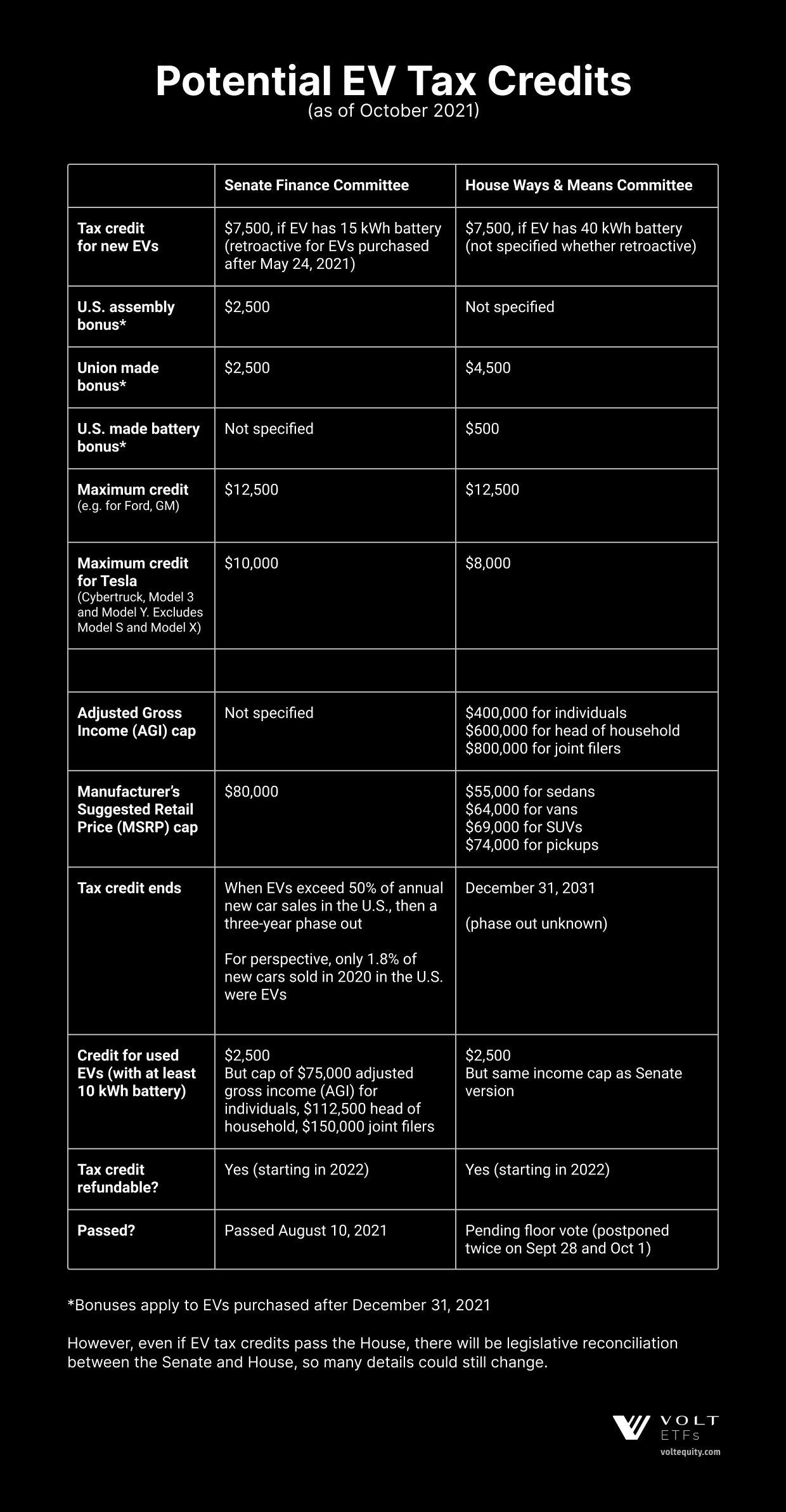

The Tesla EV Tax Credit

Source : www.voltequity.com

did they pass the tax credit|TikTok Search

Source : www.tiktok.com

State Representative Geoff Luxenberg

Source : www.facebook.com

Who gets a break? Clashing ideas on tax relief are teed up for the

Source : apnews.com

Retroactive Tax Credits 2024 Meaningful Historic Tax Cuts | Connecticut House Democrats: Opinions expressed by Forbes Contributors are their own. I write about how to maximize your automotive investment and more. As part of the highly-touted Inflation Reduction Act, Congress extended . In 2021, lawmakers enhanced the Child Tax Credit for that year only $1,800 for tax year 2023 $1,900 in tax year 2024 $2,000 in tax year 2025 The first line item would clearly have to be .