Wake County Property Tax Rate 2024 Election Results – Wake County’s property tax rate for 2024 is .657 cents per $100 of property value, according to the country. The revenue neutral rate at the new appraisals would be .4643 cents per $100 of value. . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential properties rose an average of 53% in tax value .

Wake County Property Tax Rate 2024 Election Results

Source : www.wake.gov

Wake County revaluation results: home, commercial values soar

Source : www.newsobserver.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

New, higher Wake County property values are out this week. What

Source : www.yahoo.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Appeals: Informal Review and Formal Appeal | Wake County Government

Source : www.wake.gov

July 2023’s Median Price of Wake County Real Estate decreases by

Source : www.wake.gov

Wake County election ballots include proposal for new parks

Source : www.cbs17.com

Need Help Paying Your Property Tax Bill? | Wake County Government

Source : www.wake.gov

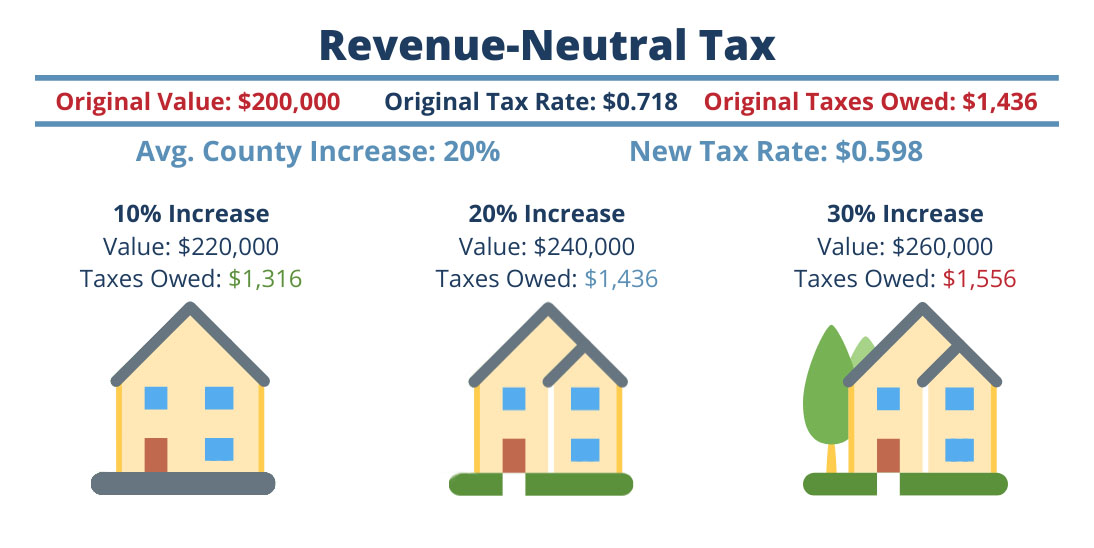

Some Wake Residents Could Save $ If The County Goes Revenue Neutral

Source : www.johnlocke.org

Wake County Property Tax Rate 2024 Election Results New property value notices to hit Wake County mailboxes starting : If you’ve got sticker shock after seeing your new Wake County property tax You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax . Wake County voters could see a nearly $100 million “We went looking for property in that area to put a library on and we just couldn’t find any with a suitable price that we were willing .