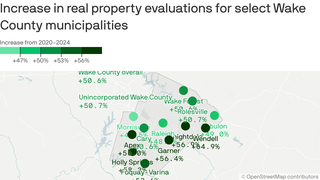

Wake County Property Tax Rate 2024 Per County – Wake County’s property tax rate for 2024 is .657 cents per $100 of property value, according to the country. The revenue neutral rate at the new appraisals would be .4643 cents per $100 of value. . Travis Long tlong@newsobserver.com Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential .

Wake County Property Tax Rate 2024 Per County

Source : www.wake.gov

Wake County’s tax evaluations soared in value. Here’s what

Source : www.axios.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Board of Commissioners | Wake County Government

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Raleigh Downtown | Raleigh NC

Source : www.facebook.com

Wake County unveils $1.8 billion budget plan that includes

Source : abc11.com

Real Estate | Wake County Government

Source : www.wake.gov

Wake County Property Tax Rate 2024 Per County New property value notices to hit Wake County mailboxes starting : Wake County residential property values are up 53% compared to four years ago, according to revaluation numbers posted Friday by the county. If the proposed revenue-neutral tax rate of $0.4643 per . RALEIGH, N.C. (WTVD) — Homeowners in Wake County may soon have to pay more in property taxes. County commissioners said they expect property values to increase when 2024 revaluations are sent out. .